Business Intelligence (BI) software at the heart of operational management

Decision-making software (also called business intelligence) is a computer program designed for company managers. It specifies the means, tools and methods that allow the tangible or intangible data of a company to be collected, modelled and recovered, with a view to provide decision-making assistance and enable the decision maker to have an overall view of the business activity being analysed.

Reporting is probably the most used application of business intelligence, allowing managers to:

- Choose data relating to a particular period, a particular production, a particular sector of clientele, etc.

- Classify, combine or split this data according to criteria of their choice

- Perform various calculations (totals, averages, variances, comparison of one period to another, etc.)

- Present the results as a summary or in a detailed manner, usually as a graph, according to their requirements or the expectations of the company managers

Reporting is supplemented by the balanced scorecard, which in turn is an assessment tool of the organisation of a company or an institution, consisting of several performance indicators at a given moment or time period.

A balanced scorecard consists of a set of indicators (defined by consensus), information gathering procedures and operating procedures (use of the results). It helps meet the following management objectives:

- To assess performance

- To carry out an assessment of the situation

- To communicate and inform

Balanced scorecard and reporting: objectives and principles

A balanced scorecard’s objective is to guide the organisation through indicators (grouped in a balanced scorecard) and to inform the hierarchy of the results. The main goal is to provide assistance in decision-making and in the overall strategy of a company or a department in particular.

The balanced scorecard is a set of analytical indicators, drawn up periodically and meant for the manager, in order to guide his decisions and actions for achieving the performance objectives.

The balanced scorecard:

- allows monitoring by the management, by highlighting the actual and potential performances as well as the failures.

- serves as a medium of communication between managers

- promotes decision-making, after the analysis of noteworthy values, and the implementation of corrective action

- can serve as a monitoring tool to help identify new opportunities and risks

Reporting, on the other hand, is a set of result indicators, drawn up periodically a posteriori, and is used to inform the hierarchy about unit performances.

As part of a decentralised management, reporting makes it possible to verify that the responsibility centres comply with their contractual obligations.

In short, the balanced scorecard is an analytics tool, while reporting is a monitoring tool. The two function together and complement each other.

What does a balanced scorecard look like?

Although, by definition, there is no standard balanced scorecard, certain rules related to its structure and the quality of information that it contains applies to all balanced scorecards.

A standard methodology to develop a balanced scorecard:

The implementation of a balanced scorecard involves an in-depth reflection on the parameters to be monitored (called the key factors of success) and on the characteristic performance criteria of these key factors of success. The difficulty in developing a balanced scorecard lies in selecting indicators from the mass of information provided by the accounting and management control systems. The balanced scorecard consists of analytical indicators, i.e. a set of monitoring and result indicators.

The choice of indicators is crucial: they are obviously directly related to the type of business activity and to the important elements that must be known in real time or anticipated in the short term.

The indicators must be:

- pertinent: they must, in a timely way, meet the requirements of the manager for whom the balanced scorecard is intended.

- rapidly obtained in order to carry out corrective action in time. The speed of obtaining the information is prioritised over its accuracy.

- summarised: all of the indicators must give an overall, comprehensive picture of the company or of the manager’s field of activity.

- contingent: they must comply with the current situation and expectations. The balanced scorecard will therefore not have uniform content, neither across departments nor over time, even if it must have a certain amount of stability in order to carry out comparisons over time.

The right indicators are specific to each business sector and each company. A good software supplier can advise SMEs and middle-market companies on the implementation, training and daily use of the management and reporting software.

Clarifications from Stéphane COIRRE (AGI), an expert with 30 years of experience in integrated management solutions and reporting

1. What is the primary interest for a manager to resort to reporting and balanced scorecards to successfully carry out their tasks?

To take major and minor decisions on quantifiable facts.

The balanced scorecard allows the performance of a company or a department to be gauged over time, using stable indicators. It responds to the issues of governance and the long-term strategy of the company.

Reporting allows an analysis to be produced at a certain point in time. It responds to an ad hoc requirement, a cost study, or a short- or medium-term decision to be taken.

These tools are indispensable to the proper functioning of the company in the short, medium and long term.

Without these tools, the manager is playing it by ear! Nowadays, there can be no strategic management without analysing this data in the short, medium and long term!

2. A few examples of what’s possible with reporting, depending on the sector of business.

Here are some concrete examples:

HR Reporting

Allows differences in salaries, expenses, absences and team schedules, the workforce (recruitment, turnover, etc.), the distribution of payroll, age pyramids, changes in position-wise training patterns to be analysed, etc.

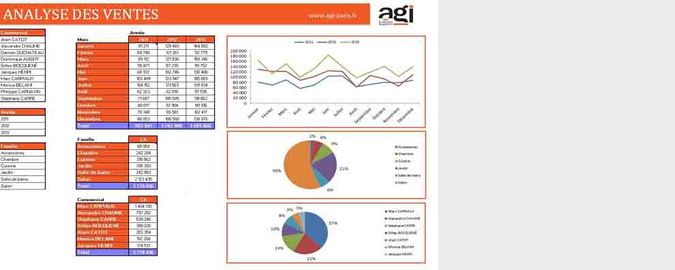

Sales Reporting

Allows sales to be monitored and the number of customers and prospects visited, the number of business proposals drawn up, the order conversion rate, turnover trends, trade margins, classifications (product-wise, customer-wise, region-wise) to be determined, etc.

Funding decision

Allows the cash flow to be closely monitored, the difference between the actual expenses and the budget to be analysed, summary tables for accounting, purchases, sales and inventories to be created, the intermediate management balances in real time to be calculated, etc.

3. What are the limitations of these tools?

One of the main difficulties is that the data is often scattered between different software and different files. The BI and reporting software are THE solution, as they make it possible to aggregate the different information on the company into a data warehouse and provide tools for examining this data… Business Objects, Hyperion, Cognos... to cite the best known ones.

These tools are considered to be complicated and require lots of resources to be implemented by the managers who are supposed to use them.

Ultimately, they turn to the alternative that they know best…..Excel! Because Excel is the ultimate solution.

For many, Excel is a magical tool.

It is an inexpensive, powerful and universal tool, ideal for creating tables, graphs and supporting PowerPoint presentations or PDFs. In addition, it can be integrated into BI tools.

I can confirm that: “Whether we like it or not, despite the most visually pleasing BI tools in the world, 90% of balanced scorecards end up in Excel.”

However, it must also be acknowledged that Excel has many disadvantages:

1. There is no data security. “In many companies, employees send each other Excel files with the entire client file, including their stock-in-trade. This is a major flaw.”

2. The file size. Too much data fed in and the Excel file becomes too large to be sent via email and regularly crashes the company’s network.

3. Excel is very time consuming, as it is very manual.

4. Data input or formula errors. “The spreadsheet suppliers report 1 error per Excel sheet.” We believe that 35% of the balanced scorecards contain errors.

5. Lack of collaborative work, no synergy of requirements: very often, each department creates its own “labyrinth” to produce the same final report!

6. No mobility, no alerts…

AGI has taken note of all these different observations:

MyReport is a type of software that retains all the advantages of Excel without the drawbacks. Being simple to use, MyReport guarantees data security and above all, gives the end user a great deal of autonomy. This software enables operating managers and leaders to create analytical tables in office environments they are already proficient in: Excel/OpenOffice or a browser.

The advantages of MyReport:

- Rapid setup

- End user autonomy

- Adapted to the size and sector of the company

- Implementation costs

MyReport represents the new generation of decision-making tools, which, due to its agility and flexibility, is capable of responding to short- and medium-term requirements, while still ensuring the continuity of existing balanced scorecards.